|

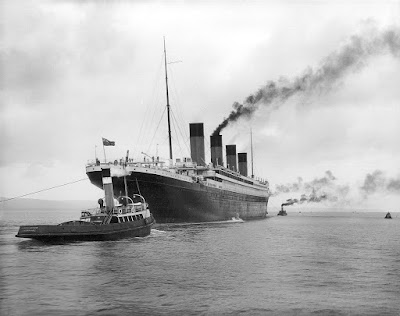

| RMS Titanic leaving Belfast for her sea trials on 2 April 1912 Picture by Robert John Welch (via Wikipedia). |

RMS Titanic was the second of three Olympic class ocean liners built by the Harland and Wolff shipyard in Belfast. Today majority owner of that company is Fred Olsen Energy ASA, headquartered in Oslo, Norway.

From the investment perspective this piece of information isn't really meaninful because close to 99% of the revenue for Fred Olsen Energy comes from Dolphin Drilling. In case you haven't followed, offshore drilling companies haven't been doing well for some time due to sinking oil price and subsequently decreasing oil exploration activity. The market for equipment and services provided by Doplhin Drilling are currently in oversupply.

Therefore, values of offshore drilling companies - like Fred Olsen Energy - have plummetted.

Fred Olsen Energy closed on Friday 22nd July 2016 at 16,10 NOK. There are 66,69 million shares so the market valuation for the company is 1073,7 million NOK which is roughly 125,5 million USD.

Compare this with the book value of just one of it's assets - the Bolette Dolhin - a drill ship built in 2014. It was valued at 584 million USD with estimated 23 years of lifetime left in end of 2015.

The most valuable assets of the company are the two drill ships (Bolette and Belford) and four rigs (Blackford, Borgland, Bideford and Byford). Rest of the fleet is valued clearly lower in the books.

The problem with all the assets naturally is that if nobody needs those ships and rigs they are essentially rendered worthless. Like Titanic after it hit the iceberg and sank.

In Q2 report the company estimated contract backlog for it's ships and rigs being 650 million USD. Most of the current contracts will end between September 2016 and March 2017. After that only two contracts continue: Bollette and Borgsten.

This means that any changes in contract status will have huge effect on the valuation of the company. There is also an outstanding legal dispute about Bollsta Doplhin (new build which was cancelled) where claims are larger than the current valuation of the company on both sides.

Eventually, the key for survival from my perspective seems to be how they are able to manage the debt load (net debt at end of Q2 2016 ~969 million USD) to a level they can carry with the remaining contracts until the market stabilizes. Currently they are getting still good cash flow from operations but it's trending lower (Q1 2016: 115,6 million USD ; Q2 2016: 90,2 million USD).

Certainly very risky investment (turnaround bet) at this time. Nevertheless, I am willing to take the risk and assume there will be a turnaround in time (to me it seems they need new contracts before end of 2017).

By the way, Friday 22nd of July also CFO of Fred. Olsen Energy ASA (Hjalmar Krogseth Moe) seems to have initiated position of 10,000 shares at a price of NOK 16.40 per share.