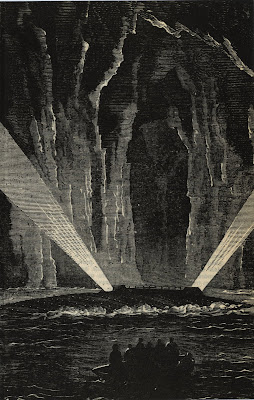

Deepsea Delta semi-submersible drilling rig in North Sea (source: Wikipedia)

Unfortunately, oil is very much needed by the global economy now and far into the future. Therefore, oil drilling and transportation will have to continue. All the easy oil deposits have been probably already found in the land and under the sea. The demand for deepwater drilling rigs have been growing and the demand for shallow water rigs have been declining or staying flat for years (reference: see page 14).

I have been looking more companies in the oil and gas sector to my portfolio and Fred Olsen Energy (Oslo OSE: FOE) looks attractive. Fred Olsen Energy provides exploration and production services to the offshore oil and gas industry. It has 7 drill rigs, 1 accomodation platform and 1 drill ship which it rents for oil and gas companies. Currently it has no exposure to Gulf of Mexico. Most of the rigs are in the North Sea currently.

Compared to many of its competitors Fred Olsen Energy is small. However, the offshore drilling segment of the company is very profitable. Engineering and fabrication segment is loosing money, but the amounts are not significant compared to the main segment. The balance sheet reveals that the company has quite high debt load. However, it looks to be manageable especially in the current abnormally low interest rate environment.

The first half of 2010 has been weak in terms of revenue, but still the company has respectable cash flow from operations. The contract status of the fleet seems to be also in order. Five out of Nine rigs/ships have contracts in place until 2013-2015. The rest are shorter term. There seems to be a slight oversupply still in the floater market. I am sure that that and the contract status are reflected by the valuation of the company already.

What caught my eye in the first place was the forecast figures I saw in recent Arvopaperi magazine for this company (source: Facset):

P/E 2010: 4,9

EV/EBITDA: 4,2

yield: 8,19 %

The forecasts are even better for 2011. Looking at the Q2 raport from the company, I am not sure if these are conservative enough given that both revenue and profits are way down from 2009. At any rate, these valuations are so low that I think there is sufficient margin of safety for me. The latest dividend was NOK 10. The shares of the company are trading right now at 178 NOK.