Talvivaara Mining Company Plc. (LSE: TALV; Nasdaq OMX Helsinki: TLV) has an open-pit Nickel mine in Sotkamo, Finland. The project leverages one of the largest known sulphide nickel resources in Europe. Production at the mine started in October 2008 and production ramp up is still ongoing. The planned annual nickel production is 50,000 tonnes. As by-products the mine will also produce approximately 90,000 tpa of zinc, 15,000 tpa of copper and 1,800 tpa of cobalt. Also uranium can be extracted profitably from the ore if Finnish state gives OK for this. Talvivaara uses a process called "bioheapleaching" to extract the metals from ore.

Talvivaara has 1121 million tonnes of mineral resources in ”measured” and ”indicated” categories and additional 429 tonnes in category ”inferred” (no reserves). Mine life is expected to be close to 50 years. This analysis concludes that Talvivaara, once in full production, should have revenues at close to 1,2 billion euros (at current metal prices). Possible uranium extraction, end of Zinc streaming agreement and near mine exploration will be increasing the revenues and the result in the long term.

Given the current stock price of 6,6 euros (Helsinki stock exchange), to me it seems that market values Talvivaara at P/E 9,5-11,8 against intermediate 30ktpa Nickel production (target 2011, but there are concerns to that end). However, given full capacity of 50ktpa Talvivaara is undervalued at current metal prices at P/E below 4.

I personally like Talvivaara because it is a local (Finnish) project, has long expected mine life and to me looks like attractively valued when taken into account the full production targets.

Introduction

Talvivaara Mining Company Plc. (LSE: TALV; Nasdaq OMX Helsinki: TLV) has an open-pit Nickel mine in Sotkamo, Finland. The Talvivaara polymetallic deposits, Kuusilampi and Kolmisoppi, comprise one of the largest known sulphide nickel resources in Europe.

Production at the mine started in October 2008 and production ramp up is still ongoing. The target for year 2011 is to produce 30,000-35,000 tonnes of nickel. However, since they could not sustain 30,000 tpa production rate in 2010 than only for a while, the target seems to be tough to say the least.

The planned annual nickel production of 50,000 tonnes is anticipated to be reached in 2012, but let’s see first what happens in 2011. At any rate, I will be analysing the company with the full production rates in mind. It may happen 2012 or then get delayed. To me it does not matter as it does not fundamentally change the outcome of the analysis.

As by-products the mine will also produce (at full production) approximately 90,000 tpa of zinc, 15,000 tpa of copper and 1,800 tpa of cobalt. Also uranium can be extracted profitably from the ore if Finnish state gives OK for this. Talvivaara use a process called "bioheapleaching" to extract the metals from ore.

Talvivaara has launched ”Operation Overlord” to study and implement expansion beyond 50,000 tpa Nickel production. Scoping study is scheduled for 2011 and production ramp up target is 2015. Talvivaara states that they have also excellent near-mine exploration potential especially between Kolmisoppi and Kuusilampi deposits.

Mineral Resources

Talvivaara has 1121 million tonnes of mineral resources in ”measured” and ”indicated” categories and additional 429 tonnes in category ”inferred”. Resources in the lowest category (”inferred”) have more uncertainities regarding tonnage and grade compared to highest category (”measured”).

Table 1. Mineral Resources.

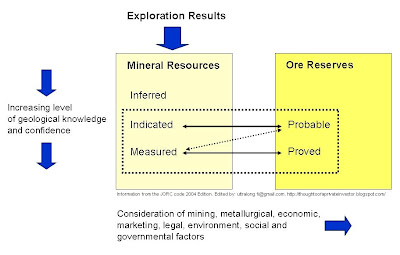

Talvivaara does not have Mineral reserves (either ”proven” or ”probable”) yet. The reason for this is unknown to me, but according to the Australasian Code for Mineral Resources and Ore Reserves or ”JORC code” that Talvivaara have used as basis of its resource statement it requires not only geological facts, but also ”Consideration of mining, metallurgical, economic, marketing, legal, environmental, social and governmental factors” to upgrade ”measured” resources to ”proven” and ”indicated” resources to ”probable”.

Picture 2. The relationship between mineral resources and Ore Reserves as described in the JORC code (2004 Edition).

Chris Morrissey, a former chief geologist of the Rio Tinto Group, explains the ins and outs of resource/reserve statements in the arcticle titled ”In the opinion of a Competent Person” published Rio Tinto Review magazine, issue 80: ”With some deposits there is so much natural variability, for instance in grade and shape, that the high levels of confidence needed for proved reserves are impossible to achieve. Nuggety gold veins are an example of that, as are diamond deposits in which much of the value comes from stones of exceptional size and quality which are so rare that no amount of sampling can safely indicate how often they will be mined."

"Reserves are the highest form of mineral asset a mining company can have. They are not as good as money in the bank, but they can be given a monetary value in the company’s balance sheet. They are normally replenished from resources attributed to the same operation, by building up positive information on the largely non geological matters listed. Technical and economic matters are only part of it; reputational considerations are very important too, as well as questions of title and ownership. It is a two way street, meaning that reserves can be “demoted” if crucial information proves faulty or turns negative.”

Calculating from the resource statement one can get the amount of each metal Talvivaara assumes to be in the ground. The calculation assumes 100% accuracy in the statements 100% recovery of each metal.

Table 2. Amounts of metals in the ground.

I have seen statements of mine life varying from 46 years to 60 years. If calculating from the above table, one gets 52 years and 69 years for mine life assuming 100% accuracy/100% recovery for M+I and total resources respectively. Clearly, Talvivaara does not assume 100% recovery so their statements regarding mine life are less than the ”ideal” calculation suggests. In any case, 50 years or so is eternity in the modern investment world.

Metal Prices

In my analysis, I use the following metal prices (USD / metric tonne):

Metal: 5 Year Lows: Current Price level

Nickel $10000 $28000

Copper $3000 $9750

Cobalt $30000 $42000

”Base case” will later indicate ”Average of Current price and 5 year lows” for these metals.

EUR/USD = 1,35

Zinc* $472.5/t

Uranium (Yellow Cake) 50 USD/lb (82 EUR/kg)

*) The Zinc price reflects the 1.25 Mt streaming agreement that will be in place for the next 14-17 years depending on production ramp up (i.e. when 90 ktpa capacity is reached). According to the agreement there will be 350 EUR/t fee and 335 million USD pre-payment against the first 1.25 million tonnes of Zinc from Talvivaara.

Below you can see 5 year price level in the London Metal Exchange for each metal courtecy of metalprices.com.

LME Nickel Prices 5 Years

LME Zinc Prices 5 Years

LME Copper Prices 5 Years

LME Cobalt Prices 5 Years

Value of Talvivaara production

Assumptions: Copper 75% net smelter return. Cobalt 59% net smelter return.

Production level 30 ktpa Nickel (2011)

Table 3. Value of production (30ktpa Nickel)

*) Streaming contract.

Production level 50 ktpa Nickel (2012)

Table 4. Value of production (50ktpa Nickel)

*) Streaming contract.

Potential additional profit

Uranium

Table 4. Value of potential uranium production

Zinc

Table 5. Additional profit from Zinc production once the streaming contract ends.

Valuation of Talvivaara Mining Company

The following calculation assumes:

- Operational costs 2011: 245 MEUR, 2012: 270 MEUR

- Depreciation etc. 2011: 60 MEUR, 2012: 64 MEUR

- Capital expences 2011: 80 MEUR, 2012: 30 MEUR

- Finance costs: 30 MEUR/a

- Corporate tax level 26%

- Talvivaara stock quote in Helsinki 25.2.2011: 6,6 EUR

- Stocks (fully diluted): 263,669,291

- Attributable to owners: uses same ratio as used in 2010 annual P&L calculation

Table 7. Estimated profit level for 30ktpa (2011) and full capacity (2012).

Talvivaara stock appears to be cheap if compared to what it is capable of producing at full capacity at current price levels of Nickel and other metals. On the other hand, it does not appear to be that cheap compared to 2011 production target given that it may be hard for Talvivaara to reach the announced 30-35 ktpa capacity this year. If it does achieve this and it seems that 50 ktpa production target is feasible and probable, then the stock is likely to soar as P/E 2012 under 4 is very low indeed. Even in the case of lower metal prices (assuming ”base case”) the P/E is below 7.Another way to value Talvivaara is to look at statements it is has made regarding net cash cost of Nickel. Talvivaara states that they expect net cash cost of Nickel to be 2.3 EUR/lb in 2011 and 1.6 EUR/lb in 2012. ”Net cash cost” means in this case ”net of by-product credits”. That is, all other metals are sold to lower the production cost of Nickel. Using these the Net cash cost of production for 2011 is 152 MEUR (30ktpa) and 176 MEUR (50ktpa) for 2012.

Table 8. Estimated profit level for 30ktpa (2011) and full capacity (2012-2013).

In the long term the following factors drive revenue and the result upwards:

- Increase inmetal prices (speculative)

- Possible increase of production capacity beyond 50ktpa (Operation Overlord)

- Zinc production valued at market price (takes 14-17 years)

- Increase of mineral resources via near mine exploration

- As emerging major player in Finnish mining scene, Talvivaara is well positioned to aquire projects from junior mining companies.

Full disclosure: Long Talvivaara at the time of writing.

***

Source material used in the analysis:

- http://www.talvivaara.com/about-us/key-facts

- http://www.talvivaara.com/operations/Talvivaara_operations

- http://www.talvivaara.com/operations/Talvivaara_operations/Mineral_resources

- http://www.talvivaara.com/operations/Talvivaara_operations/Exploration_and_Development

- http://www.talvivaara.com/operations/technology/advantages-of-bioheapleaching

- http://www.talvivaara.com/files/talvivaara/CMD_%20_%20others/CMD_package_2010_FINAL.pdf

JORC refers to ”The Joint Ore Reserves Committee of The Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia”.

Tonne = metric ton = 1000 kilograms

kt = kilotonne = 1000 tonnes

Mt = Megatonne = Million tonnes

tpa = Tonnes per annual

ktpa = 1000 Tonnes per annual

See also recently updated analysis:

ReplyDeletehttp://thoughtsofaprivateinvestor.blogspot.com/2011/11/updated-analysis-on-talvivaara.html