The Norra Kärr project

On May 21st 2013 Tasman Metals Ltd (TSX.V : TSM; Frankfurt : T61; NYSE-MKT: TAS) reached a significant milestone. It was granted mining lease for it's flagship Norra Kärr heavy rare earth element (REE) project. The project is closing the midpoint in Tasman's own roadmap showing timeline from discovery to production. If all goes as planned the mine construction could start in late 2014 provided that they get extraction permit and the mine is found to be feasible. Production could start earliest in 2016 according to the roadmap that can be found from company presentation (slide #28 in May 2013 version).

The Norra Kärr project is located in southern Sweden, 15km north/north-east of the township of Gränna and 300km south-west of the capital Stockholm. It is NI 43-101 compliant resource together with Olserum REE deposit also in southern Sweden. Technical report for Olserum was published recently while for Norra Kärr Tasman has completed both Technical report and preliminary economic assessment (PEA) [reports].

NI 43-101 Compliant Mineral Resource Estimate (March 2012); Norra Kärr

Approximately 50% of REE resources at Norra Kärr can be considered heavy REE. Preliminary economic assessment estimated Norra Kärr project net present value at 1,5 billion USD (Base case; 10% discount, REO basket price $51/kg). The deposit remains "open at depth" which basically means that there could be more economically viable mineralized ore deeper under the ground. Mine life is estimated at least 40 years.

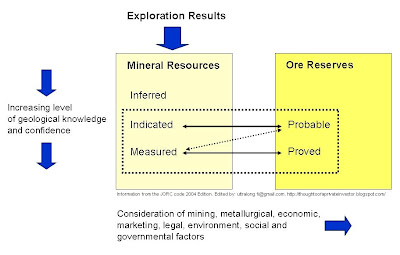

Mineral resources vs. Ore Reserves

Mineral resources that are not mineral reserves do not have demonstrated economic viability. For relationship between mineral resources (inferred, indicated, measured) and ore reserves, please check the picture below as well as wikipedia entry for mineral resource classification.

About Rare Earth Elements

Rare earth elements have geochemical properties that make them typically dispersed and not often found in concentrated and economically exploitable forms [Wikipedia]. These metals are used in many hi-tech devices. In particular, rare earth elements are used in clean energy applications such as wind turbines, electric vehicles, photovoltaic cells and energy-efficient fluorescent lighting. Clean energy technologies currently constitute only about 20 percent of global consumption of critical materials. However, their share of total consumption is expected to grow as the use of these clean energy technologies is expected to grow rapidly.

The rare-earth elements (REE) are naturally occurring non-toxic materials, whose unique properties make them essential to emerging technologies that contribute to environmental, energy efficiency and health solutions. Examples of use of REEs [source: Tasman Metals]:

- A typical hybrid vehicle contains approximately 28 kg of REE

- Large wind turbine-generators units require 2 tonnes of high strength magnets, which contain approximately 30% REE (i.e. 600 kg or REE per generator)

- Catalytic converters that transform the primary pollutants in engine exhaust gases into non-toxic compounds have REE coating

- REE phosphors in compact fluorescent lamps and LED lamps.

- Flat screen and plasma televisions

- Hard disk drives

- REE permanent magnets to generate high strength magnetic fields for MRI imaging. 700 kg of magnets are consumed in each MRI machine

Norra Kärr is source for Zirconium and the most critical rare earth elements

89% of revenue is expected to come from five metals:

- Dysprosium (Dy) 35%

- Zirconium (Zr) 20%

- Neodymium (Nd) 13%

- Yttrium (Y) 11%

- Terbium (Tb) 10%

Medium term Criticality Matric. Source: Critical Materials Strategy, U.S DOE, 2010

- Dysprosium (Heavy REE) is used in permanent magnets for wind turbines and vehicles with electric drive trains.

- Neodymium (Light REE) is used in batteries for vehicles with electric drive trains and in permanent magnets for wind turbines and vehicles with electric drive trains.

- Terbium (Heavy REE) and Yttrium (Heavy REE) are used in fluorescent lighting phosphors.

Pros and Cons for Norra Kärr

+ Contains the most critical REEs

+ EU focus (as far as I can tell this is the best shot at EU securing own REE source)

+ very low in radioactive metals compared to most other REE deposits

+ very well serviced by local infrastructure

+ open pit mine and ore body starts near surface

- Competing HREE mines coming online elsewhere outside of China might fill the same supply space (subject to separate article)

- Tasman Metals is a very small company (junior resource company) with just $7 in cash (May 2013) so it will need help from partners in the project both technically and financially

- Risks in permitting and feasibility of the mine (as with any mine at this stage)

Key financials and facts from PEA:

- Market cap of Tasman Metals: 42,5 million USD (June 9th 2013; source: Google Finance NYSEMKT:TAS)

- Norra Kärr project net present value at 1,5 billion USD (Base case; 10% discount, REO basket price $51/kg).

- Initial capital expenditures of $290 million (includes contingency of $66.8 million or 30%)

- $5.3 Billion in revenue over the first 20 years and $10.9 billion over the 40 year life of mine

- Average annual operating expenses of $74.3 million or $10.93 per kg of mixed TREO concentrate output

Full disclosure: Author owns shares of Tasman Metals.

Warning!: This is a very high risk investment!

As Wikipedia puts it (referring to NI 43-101 "national instrument for the Standards of Disclosure for Mineral Projects within Canada"):

"The promulgation of a codified reporting scheme makes it more difficult for fraud to occur and reassures investors that the projects have been assessed in a scientific and professional manner. However, even properly and professionally investigated mineral deposits are not necessarily economic, nor does the presence of a NI 43-101-, JORC- or SAMREC and SAMVAL-compliant CPR or QPR necessarily mean that it is a good investment."

the biggest problem facing TAS is that Norra Karr is located rather close to Stockholm, in the midst of farming land....and everybody familiar with the rare earth industry knows that, unlike most other forms of mining, there is radioactive spillover risk involved in mining rare earths.

ReplyDeleteI doubt the Tasman project will receive final approvals.....its proximity to major population centers and farmers precludes any hope of that.

There are compelling reasons why most rare earth projects are located many thousands of miles away from key population centers. Although that makes them expensive in terms of requirements to build roadways and other infrastructure, it radically reduces the chance of environmentalists blocking development of the projects.

Finally, in case you didn't notice, other than the Soros fund, TAS has almost no institutional ownership....and that is because most major players know full well TAS will likely never obtain permit approvals.....the farmers in the area will raise hell, and the citizens of stockholm will scream bloody hell as the project appears to become a potential reality.

Sorry, I don't consider 300 kilometers close. Also, while it's true the general public may get paranoid with any amount of Uranium/Thorium or other radioactive elements, it would still be good to put things into perspective.

ReplyDeleteTasman claims that: "The resource is unusually low in radioactive metals relative to peer projects, with less than 15 ppm each of uranium and thorium." [http://www.tasmanmetals.com/s/NewsReleases.asp?ReportID=594123&_Title=Tasman-Submits-Mining-Lease-Application-Over-Olserum-Heavy-Rare-Earth-Eleme...]

In the earths crust average concentration of Uranium is 2.7ppm. In Sweden and in Finland (where I live) the average seems to be closer to 4ppm with big local variations. I didn't find good map of Uranium concentration from Sweden, but if your look at the provided second link then may of the higher than average concentrations in Finland happen to be in the areas where most of the population lives. The largest dot in the second link marks measured local concetrations that are between 4-55 ppm.

Further in comparison to Norra Kärr's 15ppm the nuclear act of Finland does not consider concentrations under 1000ppm as Uranium ore.

Talvivaara, which is primarily Nickel mine, has around 15-20ppm Uranium in the ore. The rather low Uranium content there didn't raise much discussion until the company filed for permit to extract Uranium on site from the ore. Naturally overall concerns were ballooned as Talvivaara has faced series of environmental problems.

The first link below is an interesting study about Uranium and Radon in Swedish ground water. It seems that the Stockholm County has locations where both Uranium and Radon concentrations greatly exceed safe limits. As an example, one private well had 445 micrograms of Uranium per litre (WHO limit 15 micrograms/l). Radon, which is decay product of Uranium and a gas, has normal concentration of 10-300 Bq/l in Sweden. Concentrations over 100 Bq/l get notice and concentrations over 1000 Bq/l are considered unsuitable for consumption. Figure 4 of the report shows private water wells with Radon concentration between 1000 and 64000 Bq/l in Stockholm county. Highest reported value in Sweden has been 89000 Bq/l.

With this backdrop, and with good PR management from Tasman Metals, I don't see why population in Stockholm would be overly concerned of some mine 300km away with relatively low Uranium concentration.

[http://www.ewra.net/ew/pdf/EW_2007_17-18_05.pdf]

[http://www.stuk.fi/sateily-ymparistossa/uraani/fi_FI/uraanipitoisuudet-suomessa/_print/]